Eric See-To

Eric See-To

Did the Penang Govt break established procurement guidelines when awarding the tunnel mega-project to a company which auditors raised significant concerns and paid-up capital was 1,900 times below minimum JKR requirement?

- Public concerns were recently raised that the start of construction for the 3 roads project in Penang is at least 3 1/2 years behind schedule – despite the Penang Govt having already paid an excessive RM220mil in consulting fees to the Penang Tunnel Special Purpose Vehicle (SPV) company for reports.

- Much of these concerns center on the financial capability of the SPV company to deliver the project.

- The SPV was announced as the winner of the project via a Request for Proposal by the Penang Chief Minister Lim Guan Engon 1st March 2013.

- At that time of award, the Penang Govt had issued a statement on4th March 2013, denying that the SPV was under-capitalizedto deliver such a mega-project and claimed that the SPV had a collective paid-up capital of RM4.6 billion.

- However, checks showed that the SPV company was only incorporated on 5th July 2012 – 9 months before being awarded. At the time of award in March 2013 and contract signing, the SPV company only had a paid-up capital of RM100,000.

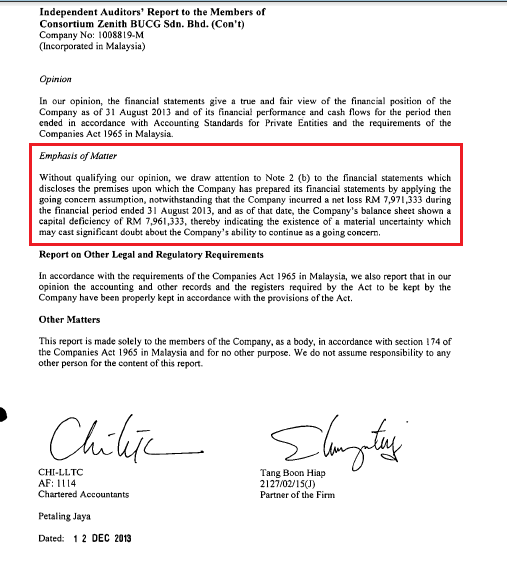

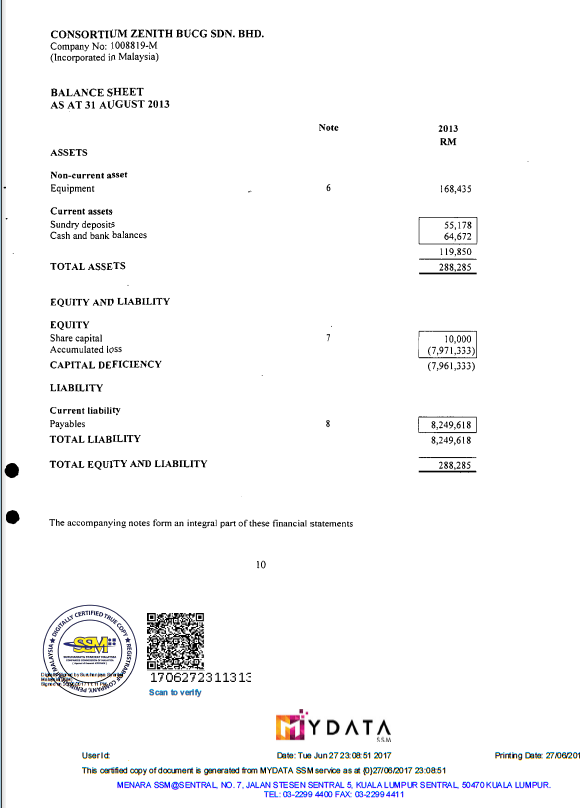

- More worrying is that as at its financial year end of Aug 2013, the SPV company only had cash balances of RM64,672 and had a negative net-worth of RM7.96mil. The SPV’s audited statement also showed that their auditors had raised an emphasis of matter that there is a material uncertainty which may cast significant doubt that the company can continue to operate as a going concern.

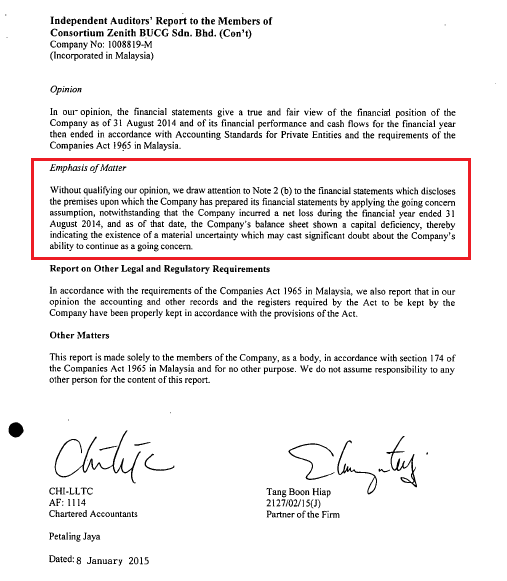

- One year later as at end of Aug 2014 – or more than a year after being awarded, the SPV had cash balances of only RM672,130 and still showed a negative net worth.

For the financial year 2014, their auditors continue to express significant doubt that the company can continue to operate as a going concern.

- Of more concern is that the parent company (PARENTCO) itself which owns 99% of the Tunnel Company was also found to be incorporated in 22nd August 2011 – less than 19 months before its subsidiary was announced to be awarded to the SPV.

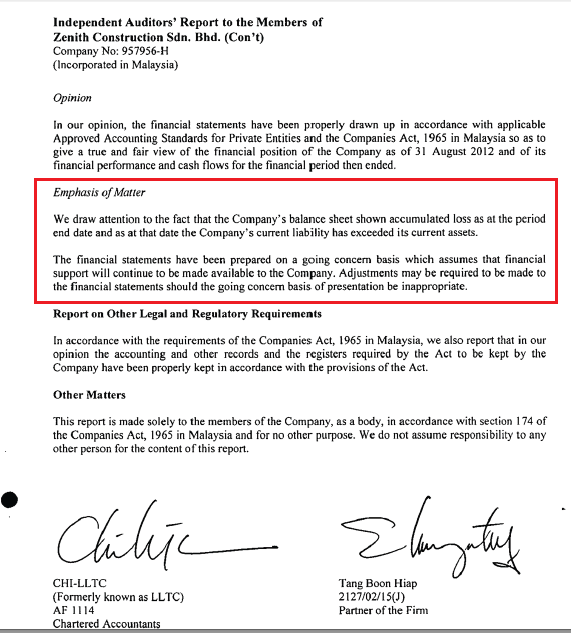

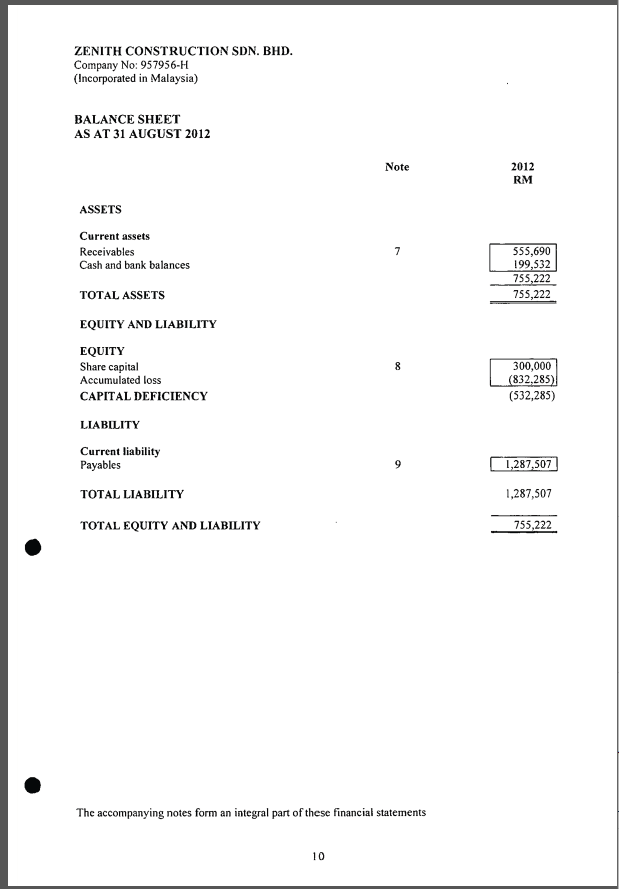

- As at Aug 2012, the PARENTCO had paid up capital of only RM300,000, a cash balance of RM199,532 and had negative reserves. Their auditors also raised a similar Emphasis of Matter showing concerns on its financial viability on August 2012 – just 7 months before the SPV company was awarded the project in March 2013.

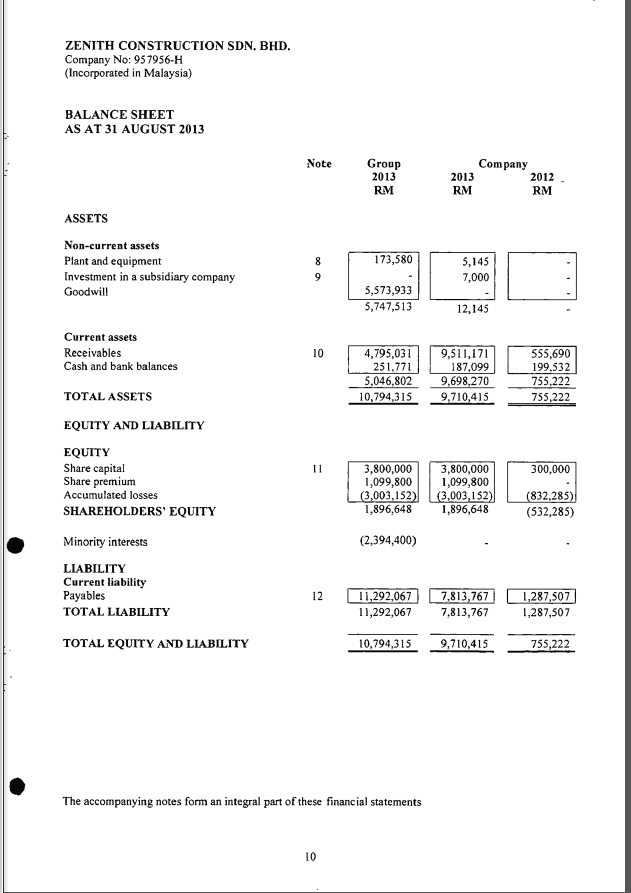

- The PARENTCO continued to register losses for the next two financial years 2013 and 2014 and had cash balances of RM251,000 and RM676,000 respectively and as at 31st August 2013, the SPV had net share holders equity of negative RM7.9mil while the PARENTCO had positive RM1.9mil.

- Added together, the share-holders equity of both the SPV and the PARENTCO had a equity of negative RM6mil as at 31st August 2013 – 5 months after the project was awarded by the Penang Govt.

- When doing a financial evaluation for a Request for Proposal (RFP), the Jabatan Kerja Raya (JKR) requirement is that the bidder must show financial strength of at least 3% of the contract value or the bidder would fail JKR’s standard evaluation be disqualified.

- In the case of the Penang Tunnel and 3 main roads project which cost RM6.34 billion, this 3% would be RM190.2mil.

This means that the paid-up capital of the SPV of RM100,000 at the time of award was close to 190 times below the JKR’s minimum 3% requirement.

Loading...

- Even as at June 2017 – more than four years after the award of the project, the paid-up capital for the SPV company is only RM17.5mil while the PARENTCO is at RM15mil – both of which are still below the RM190.2mil requirement and way below the RM4.6 billion paid up capital as claimed by the Penang State Government on 4th March 2013.

- Thus, serious concerns are now raised if the awarded company had the financial capability or had met the financial strength test to undertake the mega-project at the point of project award in March 2013.

- The BNSC team calls on the Penang Government to release the minutes of the RFP evaluation meetings and the related selection papers which led to the decision to award the project to the SPV in March 2013.

- The Penang Government needs to prove that it did not break procurement guidelines when awarding the mega-project to the relatively new SPV and parent companies which auditors had expressed significant doubts on, had low cash balances and low paid-up capital in relation to the project size.

Source: BNSC.my