Lim Sian See

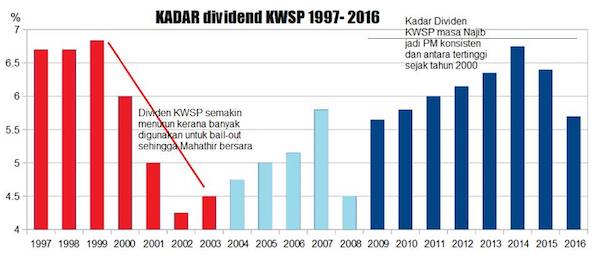

After the Economic crisis in 1998 and Mahathir pegged the currency, EPF dividends were mostly on a downward trend.

It experienced a revival after Najib became PM despite suffering from the great global recession.

It was down a little last year at 5.7% but outperformed many unit trust companies and provident funds – and was still much higher than Mahathir’s last 3 years as PM.

This year, EPF earnings have bounced back along with the market recovery and the dividends should be higher.

In fact, the general rule of investment is that the bigger the fund size, the harder it is to make above average returns.

The bigger your fund size is, the harder it is to find investment opportunities that gives above average return – it is logic and basic statistics.

EPF’s fund size has grown leaps and bound since Mahathir’s time. At the end of 2003, it was RM219 billion. Today, it is RM760 billion.

I fail to see why there are people saying that EPF’s 5.7% last year is considered low when it is a very good return for a fund of this size that is capital-guaranteed and way better than most provident funds in the world.

—

Historical dividend rates:

http://www.kwsp.gov.my/…/investment-highligh…/dividend-rates

Source: www.facebook.com/lim.siansee