Dato’ Seri Eric See-To

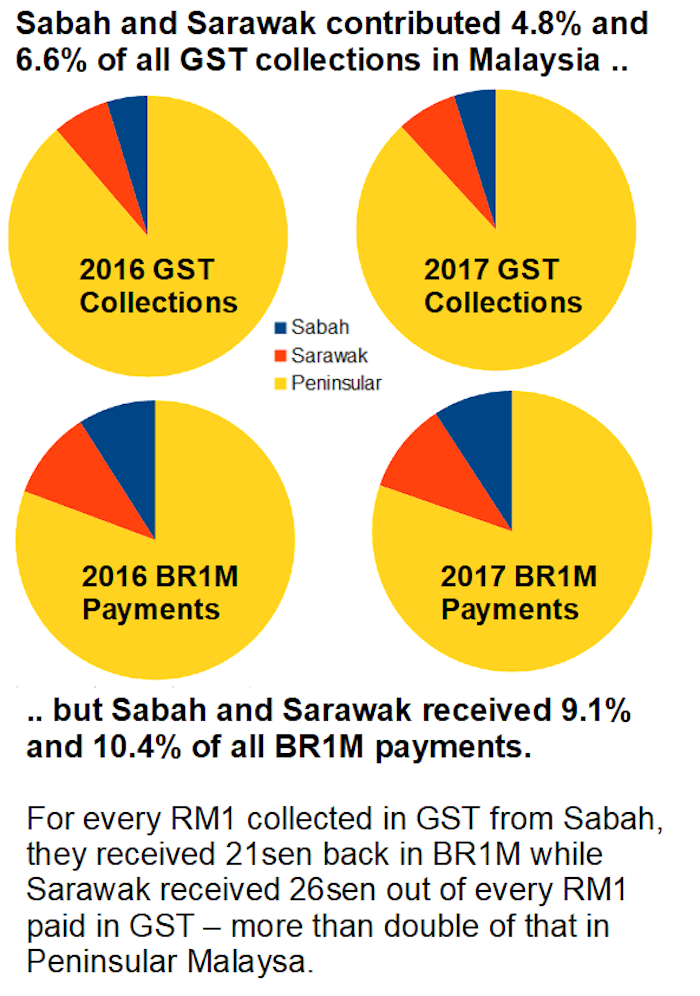

These are the GST collections and BR1M over the past two years based on official government figures.

GST 2016 – RM41.21 billion

– Peninsular: RM36.54b

– Sabah:RM1.97b

– Sarawak: RM2.7b

GST 2017 – RM44.29 billion

– Peninsular: RM39.04b

– Sabah:RM2.17b

– Sarawak: RM3.08b

BR1M 2016 – RM5.34 billion

– Peninsular: RM4.31b

– Sabah:RM482mil

– Sarawak: RM550mil

BR1M 2017 – RM6.31 billion

– Peninsular: RM5.07b

– Sabah:RM580mil

– Sarawak: RM661mil.

This means that Sabah and Sarawak contributed 4.8% and 6.6% of all GST collections in Malaysia but they received 9.1% and 10.4% of all BR1M payments.

In fact, for every RM1 collected in GST from Sabah, they received 21sen back in BR1M while Sarawak received 26sen in BR1M out of every RM1 paid in GST – more than double of that in Peninsular Malaysa.

This means that there is a definite wealth transfer back from the richer peninsular Malaysia back to Sabah and Sarawak.

Unlike in the past under Tun Mahathir where the wealth of Sabah and Sarawak was transferred to peninsular while they enjoyed little development, the GST system enables wealth to now be transferred back to Sabah and Sarawak so that they can catch up with peninsular Malaysia.

In recent years, Sabah and Sarawak have been getting a much bigger allocation of the Federal Budget for their development with huge projects such as the Pan Borneo Highway, rural development and aid and the security for Sabah’s coastlines.

This is only fair.

The figures also proves that the rich pays more GST and not the poor – again proving that GST and BR1M are fair systems to balance out development and aid to those who most need it.

Source: Eric See-To