Another Brick In The Wall

Today is the last day of Ramadhan and tomorrow begins the celebration of Aidil Fitri.

Be careful on the road to ensure a Selamat Hari Raya. Was just told a nephew had a road mishap yesterday that caused the life of his wife and child with himself badly injured. Al fatihah

This blog made a premonition of an upcoming market black hole two weeks ago. A commentator dispute us and confidently claim we will be proven wrong. It would be most welcome.

The intention behind being the prophet of doom is to forewarn the new Malaysia Baru government, who is drowned in Mahathir’s vengeance, and DAP’s impatience to undertake revolutionary change.

It is unthinkable but they seemed unaware of the current happening and implication of their actions to the stock, capital, currency and commodity market as well as the country’s economy at large.

They can’t deliver on their manifesto but resorted to cooking up bankruptcy and 1 trillion debt lies [read here, here and here] to the detriment of economic confidence on Malaysia.

No witch hunting could ever achieve any result in a matter of weeks [read here]. Its mind boggling that they intend to do so without compromising on the rule of law.

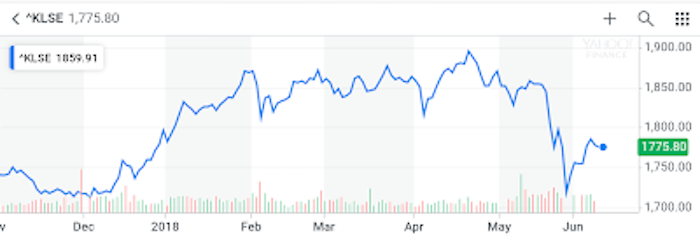

Foreigners continue selling out stocks

Bursa Malaysia did not cross critical CI support level of 1,700. The lowest was at around 1,715. It tapered off and moved sideways since then.

The worrying trend is foreigners’ selling remains. At the end of last week, almost RM7 billion worth of shares were sold by foreigners and it is not over.

Monday

Tuesday

Wednesday

Thursday

If not for Moody’s statement yesterday [read here], foreign short selling syndicate would have taken advantage of the long holiday and thin market to attempt the push below 1,700.

The Edge reported:

Foreign outflows from Malaysia stocks gain momentum

Bloomberg June 14, 2018 09:51 am +08

KUALA LUMPUR (June 14): Foreign selling of Malaysia’s stocks accelerated in the past week as the nation’s benchmark equity index fell and the Malaysian ringgit weakened.

The 5-day moving average of net foreign outflows accelerated to $69.3 million, compared with the 20-day average outflows of $60.6 million, according to data from the Bursa Malaysia Bhd compiled by Bloomberg.

The FTSE Bursa Malaysia EMAS Index fell 0.4 percent over the past week and the ringgit lost 0.5 percent against the dollar to 3.9938.

Read on here.

Yesterday outflow is the 26th consecutive days (Latest: today’s the 27th) that foreign investors pulled money out of our Bursa stock market.

On average, RM242 million is pulled out every market day by foreigners. The pace of withdrawals accelerated as in the past week an average of RM277 million is pulled out every day.

Foreigners have been pulling out money continuously since GE14 due to statements from our new Finance Minister and PH policies that was announced.

Every time Tun Dr Mahathir or Lim Guan Eng open their mouths, the more foreign investors lose confidence.

Moody’s exposed Guan Eng’s lie

Guan Eng reply to Moody is that they do not know our true debt situation. Moody do not pander to anyone. Maybe DAP think they will bow to RBA’s incessant daily slander.

While there have been cases of abuse by rating agencies on corporate rating, Moody remain one of the top international credit rating agency.

Foreign fund managers managing tens of trillion of US dollars relies on them to make their investment decisions.

He was seriously embarassed to be told government lied by Dato Najib [read here]. And his rebuttal was a typical political twist to warn not to confuse the people. Only the ignorant and naive get confused.

Ktemoc had a field day here with Mahathir who seemed to think the Japanese will lend money to a new government generating fake data and recycling old ideas like EAEC and second national car.

Japanese PM said will consider. It sounds like a reluctant banker politely rejecting loan applicants.

Despite his claim that new government wants to be more conservative in the treatment of debt, he should heed Moody’s concern on the new government’s fiscal policy.

That is unless they are not concern with credit downgrade as Mahathir said. Do not assume the cetus peribus that Moody will not downgrade Malaysia’s A- rating.

If this trend of continuing to irresponsibly shoot their mouth continues, Malaysia will be in deep trouble.

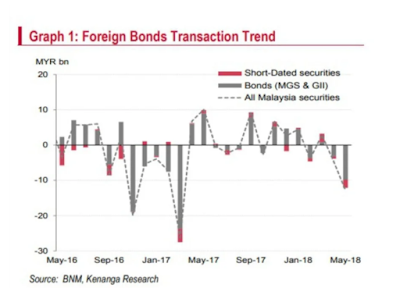

Foreigners leaving bond market

As it is, yesterday’s Edge Financial Daily reported the above concern. NST report below:

Foreigners sells RM12.9 billion of Malaysian debt securites in May

By ZARINA ZAKARIAH

June 11, 2018 @ 3:56pm

KUALA LUMPUR: Foreigners were net sellers of Malaysian debt securities for the second month, a staggering RM12.9 billion in May compared to RM4.7 billion in April, the biggest drop in 14 months or since the record RM 26.2 billion fall in March 2017.

Kenanga Investment Bank Bhd said the outflow slashed foreign holdings share in Malaysian debt securities to the lowest in eight years since June 2010 to 14.2 per cent against 15.2 per cent in April.

“Investor sentiments were rattled by the unprecedented outcome of the 14th General Election and by the subsequent news flow on the Pakatan Harapan government’s policy decisions.

“External factors were also less encouraging as the US growth indicators point north, suggesting a more hawkish US Fed.

“Along with rising global trade tensions, demand for emerging market’s bonds as a whole weakened in May.,” it said in a report today.

The month’s sell-off was broad-based across both short-dated and long-dated securities. Short-dated securities registered the largest outflow in 14 months of RM2.3 billion compared to RM638 million in April.

The 26.1 per cent decline of 6.8 per cent in April in foreign fund flows led to foreign holdings of total shortdated Malaysian bonds sliding to 53.9 per cent compared to 60.4 per cent in April.

Similarly, foreign holdings of long-dated securities (MGS + GII) recorded the largest outflow in 14 months of RM9.8 billion.

“As a result, its share slid to 25.9 per cent against 27.7 per cent in April of total long-dated debt, a 14-month low. Consequently, the average local benchmark 10-year MGS bond yields surged to 4.17 per cent in May compared to 4.04 per cent in April,” it said.

Meanwhile, the average yield gap between the benchmark US 10-year Treasury yields and the local 10-year MGS bond yields widened to 120 basis points from 116 basis points the preceding month.

“We expect continued selling pressure in the coming months following rising concerns that credit rating agencies would put Malaysia on ratings watch due to the new government’s decision to cancel large scale infrastructure projects.

“The implementation of fuel subsidies and the removal of the Goods and Services Tax which could weigh on the government’s ability to meet its fiscal target is adding pressure to sentiments.

“Additionally, the sudden resignation of Bank Negara Malaysia’s governor and the change in several government-linked corporate heads is also expected to add uncertainty to the domestic bond market.,” it added.

Rising expectations of US Fed rate hike is also expected to weigh on regional bond markets. The average 10-year Indonesian bond yield jumped to 7.18 per cent in May against 6.7 per cent in April while India’s average 10-year bond yield has climbed to 7.78 per cent against 7.51 per cent in April.

“On a bright note, the issue of the new benchmark 20-year MGS successfully drew a good demand, signalling that investors remain confident of the long-term outlook of the local bond market.

“Additionally, we expect a gradual relaxation of the forex administration rules implemented during the former BNM governor’s time to lure foreign capital. Hence, we retain our view for the current capital flight to continue in 2H18 before capital flows stabilises.

“As such, we remain optimistic of the long-term capital flow outlook which would provide BNM the flexibility to retain its Overnight Policy Rate at 3.25 per cent to accommodate growth and meet between 5.5 to 6.0 per cent economic growth target for this year.

The US indeed increase interest rate last night. However, the capital flight out by foreigners may not merely be about US interest rate but due to something beyond the usual fundamental factor.

In a video presentation that is currently viral, Israel Prime Minister Benjamin Netanyahu said, “Countries that don’t have relation with us … they’re gonna be isolated.”

Is this to come for countries like Malaysia that oppose the opening of US embassy in Jerusalem?

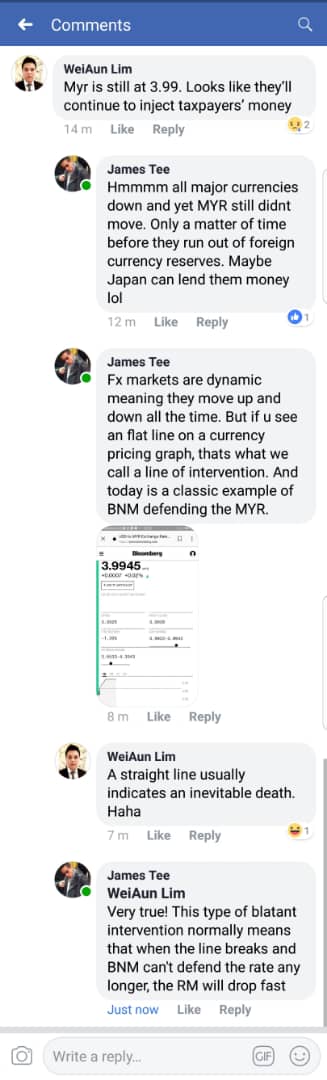

Ready for Ringgit rush

Since the GE14 result, the Malaysian Ringgit ended its uptrend from late last year to weakened at the 4.00 to the US dollar from the level of 3.90. In forex language that is 1000 points!

From a longer perspective, the chart looks below:

Mahathir made an issue of Ringgit weakening when he began his onslaught of Najib.

After Najib stabilise the economy and monetary standing, are we to see another 1998-2000 crisis with this time Najib being imprisoned for another trumped up charge?

As of yesterday, The Star here reported Ringgit begin to slide near the 4.00 level before the Fed announcement.

It does not stand a chance with all these capital outflows. The son of OUB Founder commented in his Facebook:

Pardon his language, but we share the view. It could happen over the long weekend and just mark-up after the holidays.

Certainly, it is hope to turn for the better with more clarity on government policies in days to come. The hope is there will be a new economy blueprint to achieve the Vision 2025 and beyond.

In the meanwhile, the hope is left to higher oil price and exports in the face of looming US-China trade war, capital outflow from the emerging markets and ECB plan to unwind their bond buying program.

There is no more easy monetary policy except in Japan. And yet, out of pride, Mahathir do not want anything to do with China. It will not take long before he succumb to the feet of the modern Emperors of the Middle Kingdom.

Oil Palm under pressure

Insulting the Middle Kingdom could only come at expense of local oil palm.industry.. The Star reported from Bloomberg below:

Crude palm oil falls to lowest since July 2016 on export concerns

Wed, Jun 13, 2018

KUALA LUMPUR: Palm oil for August delivery on Bursa Malaysia Derivatives dropped as much as 1.1% to RM2,300 a ton on Wednesday, lowest intraday level for most-active contract since July 2016.

The CPO futures was at RM2,303 by midday break; down 8% year-to-date.

The prices fell for 8th straight day, heading for the longest run of losses since June 2016

Sentiment is bearish after Malaysia’s crude palm oil export tax, which may affect short-term demand, says Gnanasekar Thiagarajan, head of trading and hedging strategies at Kaleesuwari Intercontinental in Mumbai.

There are concerns that sluggish demand and palm oil’s high production season from July onward will lead to higher inventories.

Weakness in U.S., China edible oil markets is also adding to the weak sentiment

Read here.

The higher inventories are beginning to be a problem before analyst will acknowledge it.

The breakeven cost for palm oil plantation is around RM2,300 per ton. Yesterday, market support broke the support level.

Palm oil may fall further to RM2,290

Reuters

June 14, 2018 10:44 am +08

SINGAPORE (June 14): Palm oil may fall further to RM2,290 per tonne, as suggested by a projection analysis.

The contract is riding on a wave c from RM2,457. The projection analysis reveals that this wave has deeply pierced below the 138.2% level at RM2,315. Chances are it may extend to RM2,290.

The bounce triggered by the support at RM2,303 looks like a pullback towards RM2,324, the May 4 low. This pullback may end around RM2,330, as suggested by a falling channel.

A break below RM2,303 could confirm the extension of the downtrend towards RM2,290.

(Wang Tao is a Reuters market analyst for commodities and energy technicals. The views expressed are his own. No information in this analysis should be considered as being business, financial or legal advice. Each reader should consult his or her own professional or other advisers for business, financial or legal advice regarding the products mentioned in the analyses.)

Sorry for all the bleak reports. And sorry for not sharing these tips earlier.

The new government has a crisis in hand. They should not be drown in their victory. Majority of 123 seats does not indicate political stability. Anything can happen beyond BN Sarawak pulling out of BN.

Oil palm will effect 800,000 small holders. They have to get to the serious business of governing and conforming to the norms of governing a nation. And they should rebuild confidence of the local and international business community.

With this reminder, we wish all readers Selamat Hari Raya, Maaf Zahir Batin. Drive safely. Do not be too festive and indulge in excesses.

Oh yes, enjoy free World Cup from the government which handsomely benefited Astro.

Source: Another Brick In The Wall

Note: If everyone who likes our content helps fund it, it would help us bring more such content in the future. For as little as RM10, you can support The Third Force, and it only takes a minute. Click the donate button on the top right or follow the link HERE if you intend to make a contribution. Thank you.