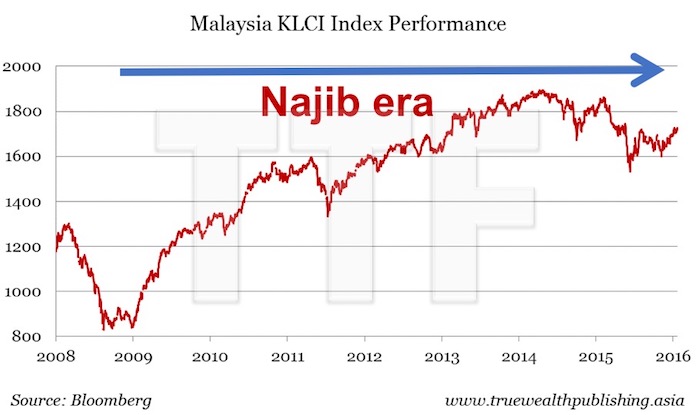

The Kuala Lumpur Composite Index under Najib was the world’s longest running bull market.

Malaysian shares have moved up 88% during this bull run.

![]()

26 July 2017: The Kuala Lumpur Composite Index is the world’s longest running bull market (READ HERE FOR BLOOMBERG ANALYSIS). Since January 2008 the KLCI has not had a 20% correction (which represents a bear market and the end of a bull market).

Malaysian shares have moved up 88% during this bull run. But it hasn’t been easy. The index hit a rough patch last year and dropped 18%. Still, it managed to recover and is up almost 2% this year (in dollar terms).

Coming in a close second to the KLCI’s bull market is the S&P 500 . Its bull market started four months later than Malaysia’s. In early 2016, the S&P 500 was down 10% but recovered. Like the KLCI, it is now up about 3% for the year.

Malaysia has a more defensive stock market. As we’ve written before, this means the KLCI has more companies that aren’t as affected by economic cycles, making it less volatile. Companies in the health care, utilities, consumer staples (like food), and telecom industries are generally more stable. No matter how the economy is doing, people will continue to smoke cigarettes, turn on the lights and use their smartphones to watch cat videos.

Also, compared to other markets around the world, the Malaysian stock market is not expensive. By taking the share price and dividing it by the net assets of a company, we can get its price-to-book ratio. The P/B is a good way to see how cheap or expensive a stock is. A lower number means the stock is cheaper. The average P/B for each stock in an exchange gives us an idea of how an entire market is valued.

Adapted from: The Street

Note: If everyone who likes our content helps fund it, it would help us bring more such content in the future. For as little as RM10, you can support The Third Force, and it only takes a minute. Click the donate button on the top right or follow the link HERE if you intend to make a contribution. Thank you.