“Why allow people to withdraw RM10,000 from their EPF savings instead of asking the government to channel RM5,000 – 10,000 directly into their accounts, particularly the accounts of those Najib himself said are suffering due to the “half baked Lockdown” by government?”

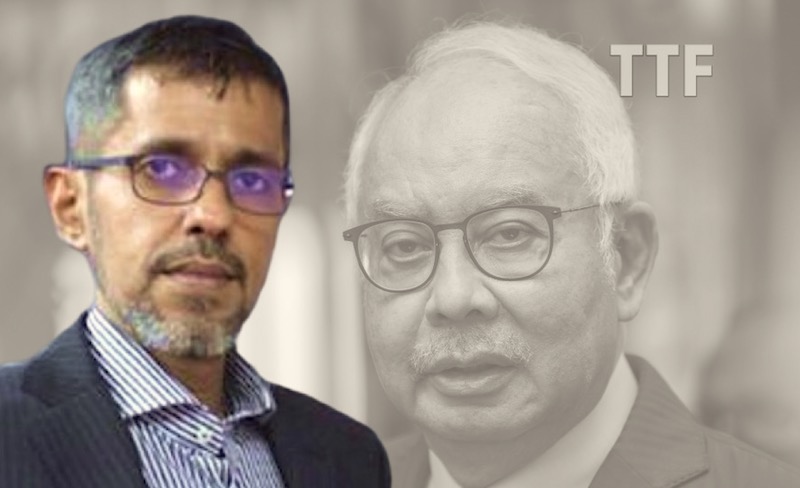

Raggie Jessy Rithaudeen

نجيب تله ملاكوكنڽ سكالي لاڬي!!!

A news report has surfaced giving an alternate viewpoint regarding i-Citra, claiming that those in favour of the EPF early-withdrawal program have a valid basis for supporting yet another withdrawal as the money can be ‘recovered’.

Referring to a Facebook entry by Datuk Seri Najib Tun Razak, the report quoted the former premier as saying, withdrawals can be managed by increasing the contribution from employers and by restructuring dividend rates.

“The government could give EPF projects as was done when Barisan Nasional was in power with me as prime minister,” Najib reportedly said.

The former added that those in support of i-Citra believe most Malaysians are responsible.

“Those who withdraw (from) i-Citra are really in need of money. Even if they were to withdraw money, they will work harder to recover their savings through EPF or some other investments,” he said.

Najib also said those in support of i-Citra are aware that the pandemic was an extraordinary situation and many have yet to recover due to prolonged lockdowns over the past two years.

He said the “one final” withdrawal could range from RM5,000 to RM10,000 for those in need.

Here’s why Najib’s suggestions are flawed:

1. If indeed the plan is to give EPF projects so that the savings fund can pay more dividend to contributors, the government must be confident enough that the said projects would result in significant returns, lucrative enough to help contributors regain their savings.

But if the government is so confident that these projects will result in such returns, why not help contributors instead by banking in money directly into their personal bank accounts, and later create the aforementioned projects to regain losses?

2. Even if EPF were to increase dividend rates, once someone has withdrawn RM10,000, the dividend is calculated based on remaining funds in an individual’s account, which is bound to be RM10,000 short.

Now, imagine a 45-year-old man who has RM5,000 left after withdrawing RM10,000 – is EPF going to increase dividend rates to such an extent, that once the man is 55, he will get almost the same amount he was due to get had he not withdrawn the RM10,000?

3. Najib admits that the government failed the people by failing to manage the pandemic properly.

He even said, the Lockdown put in place by Tan Sri Muhyiddin Yassin was “half baked” and ineffective, as it seemed to favour only large businesses, causing small and medium scale businesses to suffer and hundreds of thousands, if not millions, to lose their jobs.

So why allow people to withdraw RM10,000 from their own savings instead of asking the government to channel RM5,000 – 10,000 directly into their personal accounts, particularly the accounts of those Najib himself said are suffering due to the “half baked Lockdown” by government?

4. Najib said those who withdraw (from) i-Citra will work harder to recover their savings through EPF or some other investments.

Tell me, is that the kind of response we expect from a so-called economic expert?

Can the government simply rely on one man’s blind faith to plan ahead, by assuming, that people who withdraw RM10,000 prematurely from EPF will suddenly start working like dogs to make what they ought to have made had they not withdrawn the money?

What about the 45-year-old man I spoke of earlier?

If he is left with only with RM5,000 after making two withdrawals, he obviously does not earn that much.

Being older, less energetic and less sharp than he was when he first started working, do you think everyone like him can end up getting in 10 years what they would have gotten had they not withdrawn RM10,000?

5. Najib said withdrawals can be managed by increasing contribution from employers.

But this is the same man who once said that Muhyiddin’s Lockdown was “half baked” and ineffective, causing small and medium scale businesses to suffer.

And we’re talking hundreds upon thousands of small and medium scale businesses here – is Najib planning to make these businesses suffer more and jeopardise the economy further, rather than asking the government to own up and help these businesses directly?

Now do you understand why Najib isn’t the so-called ‘economic genius’ his minions have made him out to be?

WAJIB BACA:

Ismail Sabri sah gagal, namun MKT UMNO tidak ada hak berperlembagaan kawal keputusan Perdana Menteri