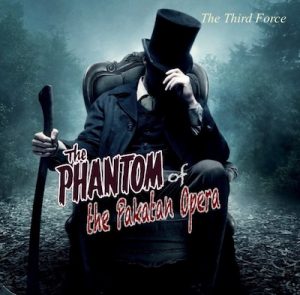

The Phantom of the Pakatan Opera

The PH government continues to accuse the previous government of hiding the “RM1 trillion” national debt.

PH claims they had no knowledge of this “RM1 trillion” number when they wrote their manifesto – citing it as the reason why they cannot deliver their manifesto.

To recap, the official government debt remains RM680 billion but PH has now added in the contingent liabilities which are mostly government guaranteed debt of GLCs in order to bump it up to RM1 trillion.

But the contingent liabilities were never hidden.

It was always reported regularly by BNM under the heading “Debt guaranteed by Federal Government”

http://www.bnm.gov.my/index.php?ch=statistic_nsdp&uc=2

The Edge reported on this frequently including their cover story in January 2018.

http://www.theedgemarkets.com/article/cover-story-debt-spiral%E2%80%93-whats-books-contingent-liabilities-and-offbalance-sheet-items

The Finance Ministry’s Special officer Tony Pua also frequently wrote about it including this article in Nov 2016

http://www.theedgemarkets.com/article/state-nation-are-malaysias-contingent-liabilities-time-bomb

There are numerous articles talking about contingent liabilities and federal government guarantees. It is impossible for PH leaders not to know about these contingent liabilities.

However, contingent liabilities are just that – contingent. It is not debt and that is why the credit rating agencies continue to insist the official government debt is RM680 billion – not RM1 trillion.

PH are now backtracking on their manifesto and using this RM1 trillion debt which they claim has been “hidden” by BN or claiming they were not aware of this.

The real reason is that PH knowingly made sweet promises that they know they cannot deliver. It is the same as lying to their voters.