![]()

What is more important than national debt is the ability for the federal government to pay interests incurred on that debt.

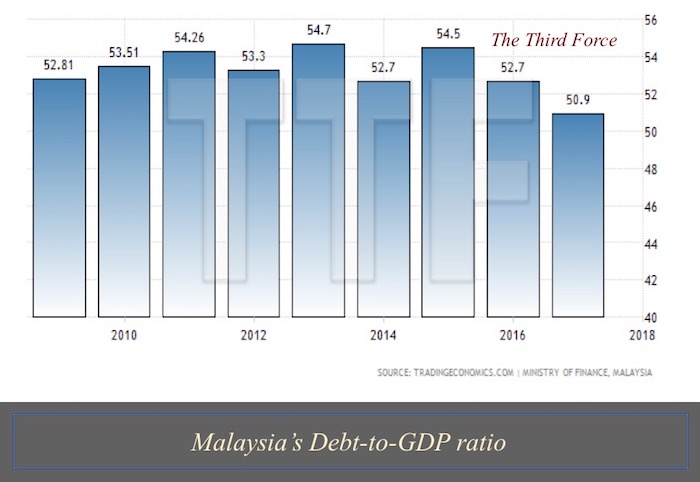

That ability is reflected in the Debt-to-GDP ratio, which basically is the ratio of the national debt to the country’s Gross Domestic Product.

Our Debt-to-GDP ratio registered an all-time 80.74 percent high in 1990 under the watch of Dr Mahathir Mohamad and the then Minister of Finance, Daim Zainuddin.

Under Najib, the ratio never once exceeded the 55 percent mark, which happens also to be the threshold beyond which the economy begins to suffer.

THE THIRD FORCE

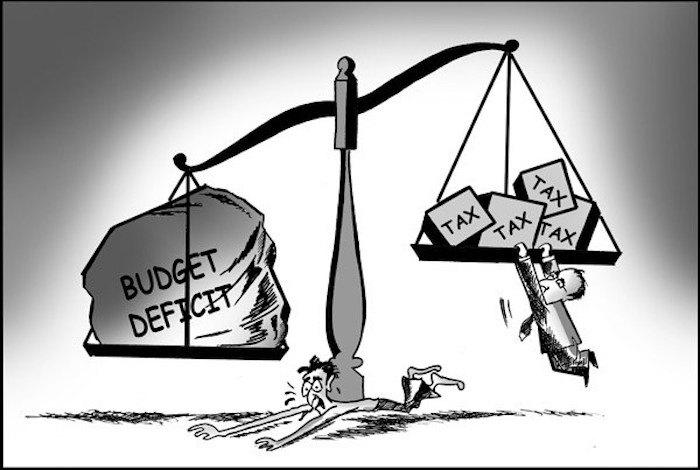

The Federal Government generates a budget deficit whenever it spends more money than it brings in. That spending includes all forms of mandatory expenditures and those that is discretional. Both these categories typically account for ninety percent or more of the federal budget and facilitates the proper running of the country.

What kinds of mandatory spending is there?

Well, any program effected as a matter of policy would require mandatory spending on a long-term basis. For instance, if the government were to have identified development initiatives under Vision 2020, these initiatives would have required long-term allocations that needed parcelling through quinquennial Malaysia plans. Suffice to say, any form of spending that is mandatory is likely to be long-term and inclusive.

That includes the budget set aside for farmers, fishermen, the elderly, general government services, international affairs, healthcare and the various allocations for the benefit and wellbeing of the people. These allocations are needed to expand the economic pie and help create a vibrant workforce that can contribute effectively towards nation building.

What about discretional spending?

Take defence, for instance.

The federal government would, over the years, have spent millions upon millions to equip the military with necessary arsenal and weaponry. Yet, there will always be a need to spend more money as technology improves and better defence systems become available. Even maintaining existing equipment can cost millions depending on how the equipment is used. These costs vary with time and are determined on an “as needed” basis.

What this means, is that the government can decide to make do without these costs if circumstances dictate that it does so. The ability for the government make that decision simply means that such costs are discretional. These costs usually account for a third of the national budget and concern only key establishments within the federal administration.

Any other types of spending we need to know about?

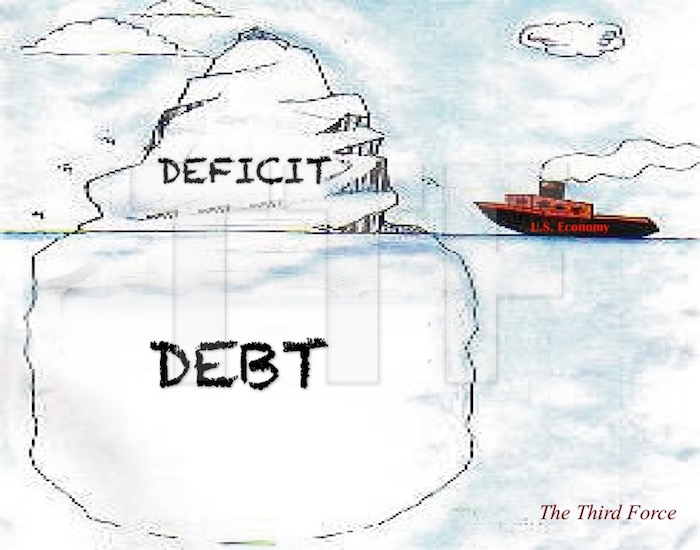

Well, the government does incur interests on the federal debt.

The federal (or national) debt is the net accumulation of annual budget deficits, i.e., the amount the government owes its creditors. Logic dictates that the higher the federal debt, the higher would be the amount the government spends servicing interests incurred on that debt.

How do creditors come into the picture?

The federal government generates revenue through income-generating measures that include the imposition of individual, corporate an excise tax. Then, you have the accumulation of wealth by government-owned corporations and the gains recorded by the central bank. But the amount earned through these avenues is never enough to compensate for the country’s expenses.

And that’s when a budget-deficit comes into the picture.

To operate under a budget-deficit, the Ministry of Finance and/or companies’ attendant thereto issue bills, notes, bonds, and at times, provide guarantees for bond programs that almost always run into the billions. These programs help make up the difference between revenue and expenditure and allow the government to function normally.

Of course, by issuing such securities, the government incurs costs (interests) that it needs to pay purchasers of those securities. These purchasers effectively become creditors who ‘loan’ money for the government to spend. Needless to say, the higher the amount of money ‘loaned’, the higher would be the interest the government needs to pay them.

Is that a bad thing?

Not at all.

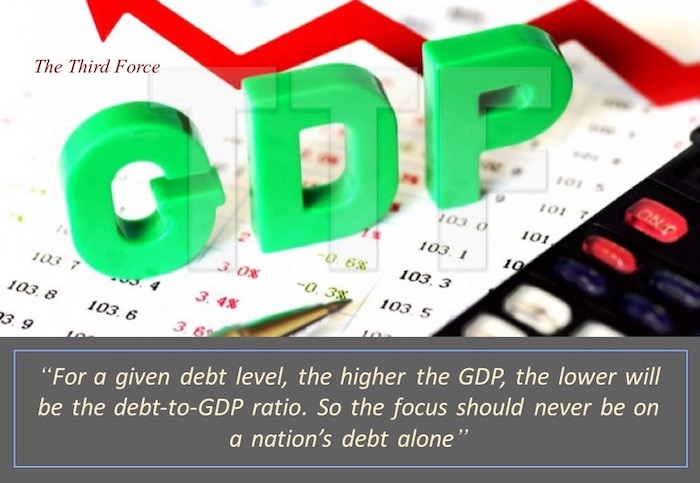

What is more important than the national debt is the ability for the federal government to fulfil its obligations (interests and principals). That ability is reflected in the Debt-to-GDP ratio or the ratio of the national debt to the country’s Gross Domestic Product. For those of you who don’t already know, the GDP is the total monetary value of all final goods and services produced by the country in a given period of time.

Our GDP is typically measured using a combination of methods that factor in the sum of income distributed among primary producers. The higher the value of the sum, the higher would be the level of our progress given our capacity to create more value on demand. That easily translates into higher income capacities and the ability of our government to service all its debt.

What was the highest Debt-to-GDP ratio ever recorded?

Malaysia’s Debt-to-GDP ratio registered an all-time 80.74 percent high in 1990 under the watch of Dr Mahathir Mohamad and the then Minister of Finance, Daim Zainuddin. Not only was that value unhealthy, it threatened to cripple the economy and almost plunged our nation into a state of bankruptcy.

What was the value like under Najib?

Between the years 2009 and 2018, the debt-to-GDP ratio never once exceeded the 55 percent mark, which happens also to be the threshold beyond which the economy begins to suffer. The stability of the ratio was the product of reforms the former premier instituted over a period of nine years. Mahathir never once achieved anything close to this despite telling us that the country was going to the dogs.

So was the country really going to the dogs?

Still need to ask me that question?