What Malaysians need to now find out is who masterminded this whole thing and who approved it? In the MAS case we know. According to Tajudin, Mahathir and Daim masterminded the deal. But who masterminded and approved the sale of TNB and TM shares to EPF and then resell them at a huge loss and hid the fact that EPF was merely being used to bail out Bank Negara by reducing its real losses of RM31.5 billion to officially only RM5.7 billion.

THE CORRIDORS OF POWER

Raja Petra Kamarudin

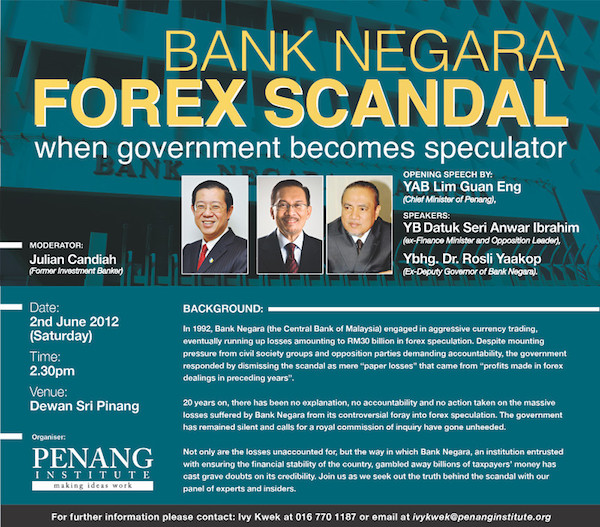

In court documents filed by Tajudin Ramli’s lawyers, Lim Kian Leong & Co, on 29th June 2012, Tajudin revealed the circumstances leading to his RM1.8 billion acquisition of a 32% stake in MAS in 1994. In his affidavit, Tajudin alleged that former Prime Minister Tun Dr Mahathir Mohamad and former Finance Minister Tun Daim Zainuddin directed him to buy those shares in MAS to help Bank Negara recover from foreign exchange losses in 1994.

Tajudin said that Mahathir and Daim had repeatedly assured him he would not suffer any losses or be held liable for anything arising from his purchase of MAS shares as he was at all times only a nominee/agent of the government. Tajudin was told the transaction was his ‘national service’ and that the whole thing was being disguised as an arm’s length commercial deal because the government wanted to create ‘paper profits’ to hide the massive RM31.5 billion losses that Bank Negara had suffered gambling on the forex market.

Since June 2012 until now, Mahathir and Daim have never disputed or challenged Tajudin’s testimony in court, which was made in the form of an affidavit. And, as Mahathir himself told Prime Minister Najib Tun Razak, if you do not dispute the allegation or prove that the allegation is false, then one has to assume that the allegation is true and that you are guilty as accused.

So, the sale of MAS to Tajudin was a bogus sale. And it was merely a paper transaction to give an appearance that the government made a profit on the sale of MAS, which they then offset against the losses of RM31.5 billion that Bank Negara made gambling on the forex market. And this was confirmed in court and has never been disputed or challenged by Mahathir and/or Daim.

Now, in 1994, when all this happened, Anwar Ibrahim was already the Finance Minister cum Deputy Prime Minister. Anwar became the Finance Minister in 1991 and Deputy Prime Minister in 1993. So Anwar was not only in the know but he was also very much in the thick and thin of this entire scam.

And not only was Anwar involved in the scam to ‘sell’ MAS to Tajudin so that they could fabricate a ‘paper profit’ to ‘reduce’ the losses that Bank Negara made, Anwar was also involved in the listing of Tenaga Nasional Berhad (TNB) and Telekom Malaysia Berhad (TM). And this exercise, too, was specifically an exercise in selling off national assets to make a profit to cover the RM31.5 billion losses that Bank Negara made.

Basically, the selling off of MAS and the listing of TNB and TM was to create billions in profits, which would be used to ‘reduce’ Bank Negara’s losses from RM31.5 billion to just RM5.7 billion. And to do this they needed to create a profit of RM25.8 billion. And this profit would come from selling MAS shares and from listing TNB and TM.

But that would be quite acceptable if the sale of MAS was genuine and the listing of TNB and TM actually gave EPF a profit. What happened instead is the government robbed Peter to pay Paul and the whole exercise was merely to bail out Bank Negara and save it from bankruptcy. In essence, EPF was used to bail out Bank Negara and for that to happen EPF’s profits needed to be transferred to Bank Negara. You rob Peter and pay Paul.

The recent RCI was told that Bank Negara was technically bankrupt. And that was because its losses were RM31.5 billion. If it was only RM5.7 billion, as the Cabinet was told, Bank Negara could withstand that and would not go bankrupt. But the losses were RM31.5 billion and not RM5.7 billion, which was too large and Bank Negara did not have enough reserves to withstand that amount.

READ MORE HERE:

The MAD Trio Of Mahathir-Anwar-Daim Behind The RM32 Billion Forex Disaster

RM5.7 Billion Lost Gambling So Where Is RM25.8 Billion More?

EPF Paid For Bank Negara’s RM31.5 Billion Losses

And that was the reason why Mahathir attended the RCI hearing the day Anwar was called to testify. Mahathir was worried that Anwar might reveal the truth behind the Bank Negara bailout and would tell the RCI that Bank Negara lost RM31.5 billion and not RM5.7 billion. Worse still, Mahathir was worried that Anwar would reveal that the so-called sale of MAS and the listing of TNB and TM were to create paper profits to ‘reduce’ Bank Negara’s losses.

What happened was Anwar allocated a huge chunk of TNB and TM shares to EPF, which, of course, EPF had to pay for at the listing price of RM5.00 and RM4.50 per share. That means EPF lost a bundle from this huge ‘investment’. These billions in profits which Bank Negara made were then offset against Bank Negara’s RM31.5 billion losses so that the losses could be reduced to just RM5.7 billion.

So, the EPF depositors lost out on what would have been tens of billions in profits so that the government could lie to the people and tell them that Bank Negara lost just RM5.7 billion and not RM31.5 billion. But today the RCI managed to uncover the truth.

What Malaysians need to now find out is who masterminded this whole thing and who approved it? In the MAS case we know. According to Tajudin, Mahathir and Daim masterminded the deal. But who masterminded and approved the sale of TNB and TM shares to EPF and then resell them at a huge loss and hid the fact that EPF was merely being used to bail out Bank Negara by reducing its real losses of RM31.5 billion to officially only RM5.7 billion.

READ MORE HERE